Succession and Governance are subjects that still need to be explored in greater depth within the business and in the family nucleus.

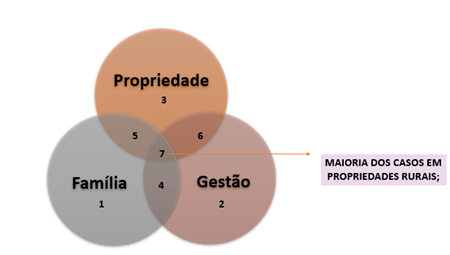

The process of professionalization of rural business has several stages, happens gradually and is closely linked to succession, as the success of succession planning depends on the professionalization of the three spheres: family, property and management.

When the family business is still in the hands of the founders, we often find roles that mix and overlap, becoming a source of conflict. At this stage (founder and children), governance is still used informally, where guidelines are usually aligned by conversations between parents and children, with little implementation of rules and regulations, and generally with no records.

When still in the hands of the founders, accountability is not very transparent or even non-existent. Decision-making is usually concentrated on the founder, and in most cases it is an additional challenge for the management of the succession, as there is still a lot of personality and the rural property is seen as an extension of the family, including in the negotiations of insertion of family members to work in the business, often not qualified for the functions they will perform.

In the image below, family, property and management are not properly separated. A classic example at this stage is using the same bank account for business and family expenses, not making the necessary separation:

In the second and third stages of Family Governance, an increasing degree of professionalization is required, since one of the great challenges is to keep the business competitive in proportion to the family's growth.

Governance in most family businesses is still informal, and therefore ends up generating trust in key people and not in structures and processes.

In this format, if people change or leave the business, there is no longer any guidance and respect for everything that has been established. Hence the need for formalization and regulation.

There is a need to have clear rules for entry, exit, remuneration, and above all, hiring based on meritocracy and not on the basis of kinship.

All these formalizations must be included in the Personnel Management Policy and in the Family Protocol, thus aligning expectations and making clear to all family and company values and their way of conducting business.

It is always worth remembering that the rules help to keep the business running and perpetuating it, and I share here a sentence that I really like to say to families:

"Rules must be established before they are necessary." When we don't need to impose or implement urgently, it is much easier to have buy-in and collaboration from those involved.

In decision making in the second stage, there is a need to implement at least one committee or management council, organized through a regiment and formalized with notices, minutes and a calendar of meetings.

Any governance structure must be analyzed in order to meet the needs depending on the family design and management dynamics, but for the most part, in the third stage (consortium of cousins), we already have a formal structure, usually composed of a Board of Directors, family, partners' agreement, specific committees, and there is a greater regulation, including a code of ethics and conduct, manuals and policies that describe the processes and procedures within the business.

Every family business has challenges, and one of the most common is undoubtedly identifying, preparing and training successors who have the profile and desire to be in the business. Other challenges, according to the Brazilian Institute of Corporate Governance (IBGC), must be observed in order to create strategies that help prepare the paths for continuity:

a) Educate the heirs to the role of shareholders/shareholders who must add value to the capital.

b) Professionalize the family and property at the same speed as the professionalization of the company;

c) Provide periodic and transparent accounts to all those involved;

d) Maintain a common objective and contain the intensification of competition for resources and power;

e) Have strategies for liquidity;

So, where to start?

Obviously each family has a specific demand, which may be related to:

> Concern about estate organization, including concerns about marriage, divorce, bereavement regimes.

> Financial or tax problems in which the family is no longer able to run the business, and they imagine that the transfer of management could be the solution;

> Death or illness of the manager or patriarch;

> Desire to organize the business and prepare a successor for a future succession, transmitting family values, family identity and management strategies.

The trinomial (or three circles) of succession can help, being a guide to start understanding the structure of the family business and its nuances:

(Image: Source: Tagiuri and Davis, 1982)

Subtitle:

1 – Family member;

2 – Company employees;

3 – Partners;

4 – Relatives and employees of the company;

5 – Relatives and partners;

6 – Partners and employees;

7 – Relatives, partners and managers;

Therefore, my tip is: start by professionalizing your business, improving decision-making and communication in all environments, improving management, introducing the habit of having transparent and accessible accountability to family members and partners, creating norms, rules and protocols to guide both current employees and future generations.

And don't forget the importance of understanding the roles and responsibilities of each one, in addition to separating the environments, so that the business survives all the setbacks that involve family and business.

And remember: succession is not replacement, it is continuity of a legacy built with great effort and dedication. Therefore, my wish is that all successors have the opportunity to experience valuable moments of exchange with the more experienced generation and to be able to walk side by side for a long time, each with their distinct contributions making the business prosper.