The climate is a factor of great influence in agriculture. Over the years, techniques and resources have been created to reduce impacts on production and bring more security to agricultural activity and rural producers. From the financial management of the property with a savings reserve, to the implementation of irrigation projects and the use of agricultural insurance, they can be tools to bring more protection.

In Rio Grande do Sul, four types of crops predominate: soy, corn, wheat and rice. In winter, the number of producers in Rio Grande do Sul who have invested in wheat cultivation has been growing in recent harvests. According to Emater/RS-Ascar, in 2021, the cultivated area of wheat in the State reached 1.22 million hectares. In the same year, 400,000 hectares of the crop were insured in Rio Grande do Sul, according to the Rural Insurance Atlas, made available by the Ministry of Agriculture.

It is important to know the ideal climate for growing wheat, as it is a cereal of great agricultural importance, especially in the southern region of Brazil, which has one of the most favorable climates for production. For the full development of the culture, researchers concluded that the ideal temperature is between 15°C and 20°C.

During heading and especially during flowering, the wheat plant is more susceptible to damage from extreme temperatures, causing sterility and reducing grain formation. It is important to keep in mind that strong winds and frost are also extremely harmful to wheat.

Therefore, we understand the importance of agricultural insurance for wheat farmers. Obtaining insurance guarantees part of the productivity of the crop, and thus manages to minimize effects on productivity in the face of climatic factors.

To better understand how the process works, check below what insurance is, what are its modalities and types of coverage.

What is agricultural insurance?

Agricultural insurance is an investment that offers rural producers protection against losses and damages resulting from climatic phenomena and adversities that affect crops. They are provided by insurance companies or through Federal Government programs, and aim to protect the producer from losses that may occur in their crops and guarantee a quality harvest.

The crops that are covered, and their type, vary by insurer. However, a large part is aimed at protecting productivity from misfortunes that may be caused by adverse climatic factors that compromise the crop as a whole.

What are the agricultural insurance coverage and which crops are insurable?

Agricultural insurance coverage is subdivided into contracting modalities, varying their coverage. In the case of wheat crops, there are two important types: named insurance and multi-risk insurance.

In the case of nominees, the events that will be covered in the policies are hail and frost. As for multi-risk, in addition to covering hail and frost, it includes other adverse events such as excessive rainfall, fire, waterspouts, strong winds, excessive temperature variations, among others.

In addition to wheat, there are other crops that are insurable. In the case of grains, the main coverages extend to soy, corn and rice. In hortifruti, tomato, banana, grape plantations, among others, can be included. The insurance also includes coverage for perennial crops, such as coffee and sugarcane, and for forests, such as eucalyptus and pine.

What are the benefits of agricultural insurance?

Agricultural insurance brings numerous advantages and benefits to the rural producer who hires it, as it avoids exorbitant losses in the event of an adverse event that harms the crop.

Another advantage is that the contract can be made by an individual or legal entity, allowing flexibility in the choice of coverage that will compose the insurance and specialized, fast and safe service.

How is agricultural insurance done and what is the cost?

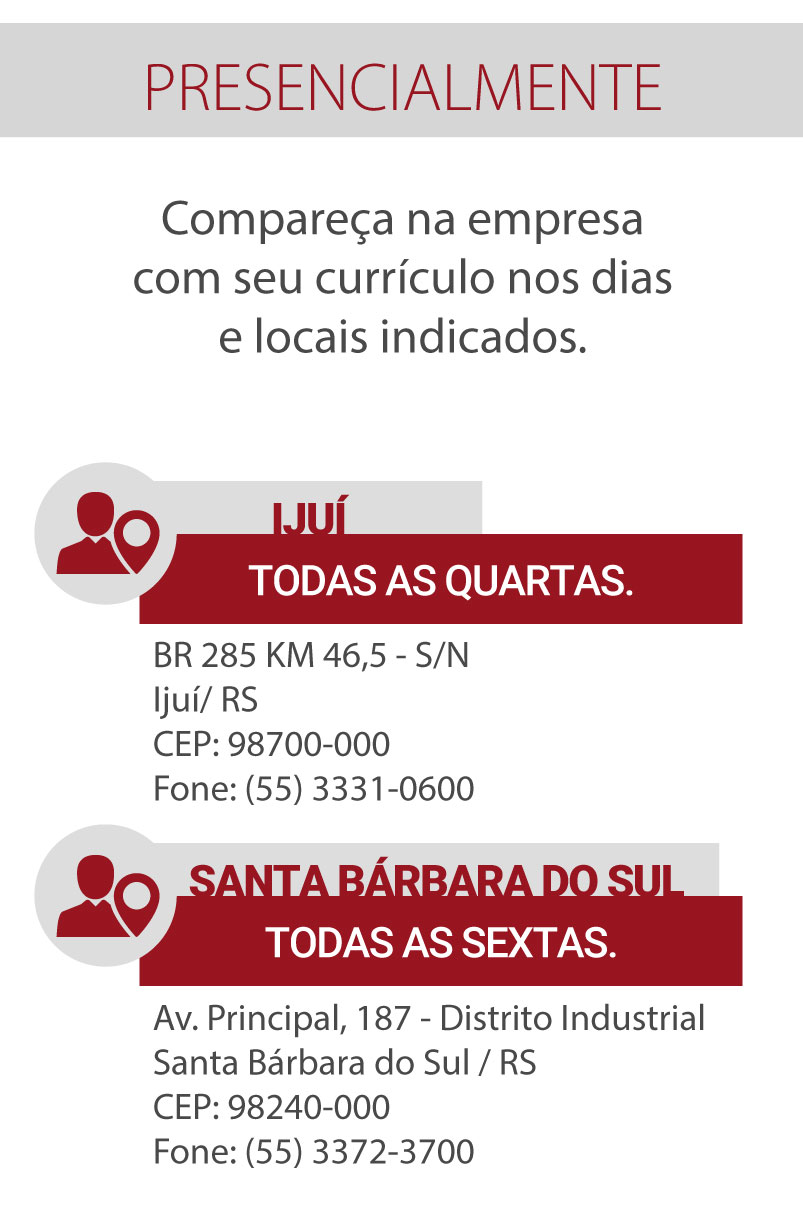

The rural producer interested in contracting agricultural insurance must go to an insurance brokerage, carrying the necessary documents for contracting. It is important to emphasize that each company has its own document kit.

The cost of agricultural insurance varies according to the region where the crop is located, the crop that the insurance will cover and which adverse events the producer wants to be included in the coverage.

Agricultural insurance brings many benefits to the rural producer when the value of the adhesion is compared to the value of the loss. Its hiring prevents excessive losses and even the end of agricultural activity, bringing security and stability.

TentosCap Corretora, the financial arm of 3tentos, provides agricultural insurance for wheat, with coverage for named risks and multi-risk, according to the needs of each client. Make a quote with us and have more protection in the next harvest. Access the website www.tentoscap.com.br/seguros and learn more.